Design principles of an economy with built-in sustainability

Lothar Mayer

Click here to download a Microsoft Word version of this essay

"Human numbers are four times the level of a century ago, and the world economy is 17 times as large. ... Oceanic fisheries ... are being pushed to their limits and beyond, water tables are falling on every continent, rangelands are deteriorating from overgrazing, many remaining tropical forests are on the verge of being wiped out, and carbon dioxide concentrations in the atmosphere have reached the highest level in 160,000 years. If these trends continue, they could make the turning of the millenium seem trivial as a historic moment, for they may be triggering the largest extinction of life since a meteorite wiped out the dinosaurs some 65 million years ago.

As we look forward to the twenty-first century, it is clear that satisfying the projected needs of an ever larger world population with the economy we now have is simply not possible. ... We are entering a new century, then, with an economy that cannot take us where we want to go. The challenge is to design and build a new one that can sustain human progress without destroying its support systems – and that offers a better life to all" (Worldwatch Institute, State of the World 1999, 1999 p. 4).

What would be the basic characteristics of an economy which "can sustain human progress without destroying its support systems – and that offers a better life to all"?

1.0 The capitalist market economy is unrivalled in its capability to generate material growth at the expense of the biosphere. The further it shakes off, under the fierce competitive pressure of global markets, any social and ecological fetters, the stronger its interconnected positive feedback cycles amplify and reinforce each other. Money begets more money, the rich become richer, the poor beome poorer, large corporations grow and merge into global giants who determine, in the place of governments who are losing their grip, the conditions of economic and social activites.

Coming into its own with the industrial revolution, an economy centered on making money out of money, the capitalist market economy, has come to increasingly control the human metabolism with nature.

As a consequence, human demands on the natural systems are no longer determined by their physiological needs, but by the expected return on capital.

In such a system, corporations and economies grow rich by turning low-entropy natural resources into high-entropy waste; part of the value thus generated is invested to transform more natural assets into monetary value, and so forth (cf Fig. 5). Thus money/capital is begetting more and more money/capital, and the exponential growth of value creation translates into an exponential growth of the claims made on natural resources and life support systems.

Basically, importing low entropy or "syntropy" and exporting high entropy is the process by which all self-organising systems create and maintain themselves. What, then, makes their man-made counterpart in the economic sphere such a ferocious, deadly competitor?

The terms entropy and syntropy are closely associated with the attempt to apply reality to the number games played by economists. The fact that most people have never heard of these terms only shows the lack of concern economists show for the laws of physics.

Entropy describes the inevitable fate of all existing things: degradation, decline, dissolution, death. A simple, everyday example of how of entropy works is the way any concentrated energy form (like the heat contained in a cup of coffee) dissipates into a room over a period of time, becoming useless waste heat.

Syntropy is another word for low or negative entropy. In apparent contradiction to the second law of thermodynamics, islands of syntropy grow in an ocean of entropy through self-organisation of dynamic systems. Syntropy is the essence of life: representing the temporary and localized suspension of entropy, it is at once created by life and enables life to flourish.

For one thing, natural systems (organisms and ecosystems) have been tied by the evolutionary process into a chain or network of sources and sinks where every "sink" for "wastes" is a source of food for other organisms so that harmful waste or poison cannot accumulate in the biosphere (see Fig. 3). For another, the growth and proliferation of all organisms is bounded by limiting factors such as free energy or material elements like nitrogen, sulphur, sodium or magnesium which do not occur in unlimited abundance. This limited abundance of resources is, as a matter of fact, one of the operating principles of evolution.

In contrast to self-organising systems in nature, however, the processes of the industrial system are depleting sources and filling up sinks at a rate which is currently making its impact felt on a planetary scale because these processes are untested by evolution and can obviously be sustained only for a few moments of evolutionary time. The growth of industrial capitalism is not bounded by limiting factors; like a fire, it is characterized, on the contrary, by unbounded self-reinforcement which will only be stopped by the exhaustion of its feed, the resources and life support systems of the planet.

A "new economy" such as the Worldwatch Institute postulates would have to break the unbounded growth dynamics of the capitalist economy by instituting a strict limitation on the consumption of natural capital without at the same time paralysing the market with its largely self-organising faculties of distribution and allocation.

1.1 What would such a new economy have to be like? It would clearly be very far from the "New Economy" which the Americans believe to have created and which, in its belief in a never-ending boom, is totally ignorant of the natural base of all economic activities. This "New Economy", even ten years after Rio, continues to behave as if it – and the humans it purports to serve – could live and survive on numbers, and as if the monetary cycles which it uses for its description were spinning somewhere in outer space.

|

|

Figure 1

|

However, since 1971 when Nicholas Georgescu-Roegen published The Entropy Law and the Economic Process, it has become generally accessible knowledge that any economic activity is subject to the Second Law of Thermodynamics. In terms of the non-linear thermodynamics developed by Ilya Prigogine in the 40s and 50s, an economy appears as a system which organizes itself by importing low entropy or syntropy and exporting entropy into its environment. Meadows (1992) has depicted this view of a physical economy in a schematic which could be regarded as an icon of ecological economics.

|

|

Figure 2: The Economic System as a sub-system of the Global Eco-System

|

The message of this schematic is

(1) that the human economy is a sub-system of a wider system, the biosphere, and

(2) that the economy on principle feeds on the same entropic flow which keeps all complex self-organising systems going.

It is not surprising to note, therefore, that ever since the neolithic revolution, when man began to step up his milking of the entropic flow with the aid of fire, tools and social organisation, this competitive situation resulted in problems of ecological degradation which, however, were on a limited local and regional scale and did not exceed the regulating capacity of the wider biospheric system. The industrial system, however, is tapping the huge low-entropy reservoirs which accumulated over the billions of years of the earth's history, with far-reaching consequences:

(1) It breaks out of the economy of nature which governs the evolution of all self-organising systems with an iron hand. The term "economy of nature" is used to describe the fact that in the natural world, self-organisation is dependent on and limited by a system's capacity to make use of the available syntropy (low entropy) provided by solar energy and other flows of free energy such as the high concentration of sulphur oxides in the effluents of volcanic vents on the bottom of the sea. All such efforts to acquire syntropy (low entropy) and to make and maintain the structures to do so are in themselves bound to increase entropy so that the balance of syntropy acquired in the process tends to be meager in most circumstances. In those exceptional circumstances where syntropy is in large supply, it will be rapidly brought down to the average level by the growing numbers of organisms which will gravitate towards this source, both in terms of individuals and of species which will develop to fill such a niche. By escaping from this economy of nature, the industrial system turns into a deadly competitor whose speed and power is a hundredfold or a thousandfold that of the other runners.

(2) Species and eco-systems which have come into being in co-evolution with one another appear as chains or more precisely networks of sources and sinks which together form a cascade of steps over which the entropic flow is utilized many times at different levels until the resulting entropy ends up as waste heat which is radiated out into space on the night side of the earth.

|

|

Fig. 3 Entropic flow cascading through the global eco-system

|

In the industrial system, this network is replaced by a flow-through mechanism which uses the sources of syntropy or low entropy provided by the sun and the life support systems of the planet and which has only one sink for its waste products: the biosphere (see Fig. 2). Viewed solely from the point of view of the Second Law of Thermodynamics, the economic process thus appears as a process which uses low entropy energy and resources of the physical world and thereby increases the entropy in its environment.

|

|

Fig. 4

|

Obviously, viewing the economic process solely as a thermodynamic process would be just as one-sided as the mainstream description in terms of value streams. The metabolism of human societies is governed by a very complex network of cultural components (i.e. values, rules, habits, beliefs and institutions like money, the banking system and the market). Thus the entropic economic process described above is driven and controlled by the money replicating machine of the capitalist market economy.

|

|

Fig. 5

|

1.3 The term "money replicating machine" must not be misconstrued as a poetic metaphor. As a matter of fact, it refers to a property of the money of the capitalist market economy which is as banal as it is absent from public consciousness - or, for that matter, from the the theories of mainstream economics.

In economics textbooks, money is described as a means of exchange, a store of value and an accounting medium. The fact that money can be augmented by lending it and getting it back with interest, or by investing it and seeing it grow year by year through the accumulation of returns, is not recognized as a property of money, but, if at all, as the property of capital (into which money transmutates, however, without further ado the moment it is invested). But even with respect to capital, there is no clear and explicit recognition that it has the ability to create value. Ever since Adam Smith, it has been assumed that value is created by work, and Marx' value theory is based on the same axiomatic assumption.

This strange inability for economic thinking to adjust itself to fundamental historical changes in the human metabolism with nature seems to one of the great obstacles for making sense of the expansionist and destructive dynamism of industrial capitalism.

It can be argued that in a subsistence or household economy which is geared to fulfil basic human needs, money - if it is needed at all - is nothing more than an elegant technology for facilitating the exchange of any surpluses. There will be no need for the volume of money to expand, since the suplusses are limited by the human ability to do

work which only in rare happy circumstances will be more than enough to generate more of the material goods like food, shelter and clothing than are necessary for human survival. In consequence, should the money supply expand under those circumstances, it regulates itself by losing its value if it turns out that there are not enough goods to satisfy the additional demand.

|

|

Fig. 6 Money as a static means of exchange for a stationary volume of goods

|

1.4 Industrial capitalism prizes the market economy out of this static situation. In an industrial economy relying on fossil fuels, money/capital that can be changed into real resources at any point is the symbolic equivalent of natural assets or, more generally, low entropy or syntropy. This is comparable to a currency that is linked to the Dollar or Euro by a fixed exchange rate - in Euroland, the Lira or Escudo or Zloty (some time soon) is as good as the Euro. A thing conceived as a mere carrier of information has become a medium that is identified with the thing it represents (e.g. real resources, energy, work) through a cause-and-effect loop so massively stable that it can be defined as a real-symbolic identity. Quite logically, the self-replicating property of syntropy (syntropy put to work extracts more syntropy) is reflected in the invested capital which, in its turn, will be increased by the incoming return. This cycle is nicely exemplified by the exploitation of a coal deposit: it is mined, then burnt to fire a steam engine which in its turn helps to mine more coal, which helps to produce steel, from which more steam engines are built, more coal is mined etc. Translated into the terms of non-linear thermodynamics, the real-symbolic identity of capital and syntropy creates a "pumped" system.

The capital/resources feedback loop turns into a hypercycle through being linked to human needs. The (human!) agents of the system who, from their own experience, know intimately the psychological profile of its customers have the capacity to invent a never-ending stream of new needs and wants. Moreover, in a mature capitalist society there is a positive feedback loop connecting, on the one side, the gratification of essential human needs (for love, support and identity) with material satisfiers (impressive homes, cars, TV, clothes) and, on the other side, the deficits and needs that are created and sustained in the process. The cycle thus established displays classic features of addiction, maintaining and feeding on itself.

The modern market economy based on industrial capitalism thus creates a perfect environment for expanding real and financial capital at the expense of the biosphere at an exponential rate.

Let me recapitulate the necessary conditions for this process:

-

a source of syntropy from fossil fuels amassed during the Earth’s history, and their systematic exploitation

-

available sinks in the shape of entropy-exporting process structures, or "syntropy generators", in the biosphere

-

the capital connection: the cultural construct of a reliable interchange an unquestioned equivalence between capital and syntropy from which the system - pumped as it is from the symbolic level - derives its self-organisational dynamics

-

human needs that supply an inexhaustible resource for creating value, enabling inexorable growth of the stream of money/capital

The last two points - the "capital connection" (1.5) and human needs as the final inexhaustible resource of value creation (1.6) - call for some further comments.

1.5 The process of value creation through the interaction of the Verwertung (expoitation) of syntropy and the simultaneous augmentation of its monetary equivalent money/capital depends, of course, on the functioning of a higly sophisticated system of money creation. Without it, the process of continuous and accelerating expansion would be unthinkable. An enterprise investing a billion to expand its production has to wait for months or even years before it can recoup the invested money by selling its products. But next year’s cars have not yet been built and the income from their sale is not yet available. So the money necessary for financing these cars does not exist. What needs to happen here is called credit creation. The billion taken out in the form of a credit has to be paid back with interest within a few years. "Let’s pretend we had the money to build a factory, then we can make cars, which we can then sell, and then we will have the money that we need now to build a factory..." - it is this kind of illusionist’s trick that has set the cycle in motion. In a stationary economy based on a pure means of exchange, this process could never get underway.

Hermann Daly who has devoted a significant supplement to Our Common Good to the subject of money creation quotes Josef Schumpeter as saying that "as late as the 1920s, ninety-nine out of one hundred economists believed that banks could not create money any more than cloakrooms could create cloaks" (Daly 1994: 415). If, amazingly enough, economists are divided about this claim to this day this is most probably due to the absence of a clear agreement about what money is. It really depends on whether you stick to a narrow defintion of money as the coins and bills emitted by a sovereign or its central bank, or whether you include what represents the bulk of modern monetary systems, i.e. the book money created by the commercial banks. Indeed, "banks do not create legal tender, only governments can do that. But banks do create customary means of payment" (loc.cit.: 415).

|

|

Fig. 8 Bank 1 takes in a deposit of 100 dollars from customer A. Under a 10 per cent reserve requirement, Bank 1 can grant a credit of 90 dollars to another customer. When customer B (or any other person who has received the 90 dollars from him) deposits these 90 dollars with Bank 2, this bank can grant a credit of 81 dollars to customer 2. At the next bank, the credit shrinks to 73 dollars, and so forth – but all these credits are adding up over the whole banking industry to 900 dollars which have been created out of the 100 dollars originally deposited.

|

The incremental money supply which is the prerequisite for the expansion of the physical economy is created in a modern economy by "the granting of credits by commercial banks to their customers (largely companies) and by re-financing of commercial banks by the Central Banks which can, basically, increase the volume of money at will" (Binswanger 1994: 94-95).

In a modern, well-managed enconomy, this "licence to print money" (which, as we have seen, it is precisely not in a literal sense) is of course qualified and restricted by a sophisticated network of conditions and controls. Central bank reserve requirements, discount and lombard rates and open-market policies are just the most visible constraints which hold monetary expansion in check. The elaborate network of further constraints which are embodied in the structure of the banking industry (such as the supervisory function of the central bank, the vetting procedures of commercial banks and other financial institutions, the information network of the rating agencies and, last but not least, the information generating potential of stock and financial markets) are most clearly demonstrated by their absence, as in the case of the crash of the South East Asian economies in 1998/1999. In a well-organised and well-managed economy, these checks are designed to and most of the time successful in keeping monetary expansion at such a level that the public has no reason to doubt that the money in their pockets or their accounts is backed by real values, in other words, that it can be exchanged at any time for the goods and services produced by the economy.

1.6 In a well-managed modern economy money grows inexorably in real terms and not just on paper as in badly managed economies. The money value of the German GDP has increased from DM 100 billion in 1950 to DM 3000 billion which means its nominal value has grown thirty times. Even if the value of the DM has shrunk significantly during these fifty years the real GDP, or real income, has grown five times bigger during that period. What is the source of this amazing creation of wealth? Has it been created by our hard work, as we like to believe, or has it been stolen from the countries of the underdevelopped South?

Since the end of the Eighteenth century the rapid development of the forces of production and the development of sources of fossil energy brought with them an unprecedented rise in real income. The capital which had been built up in the age of merchant capitalism was available for the new entrepreneurs who seized the opportunity to deploy and multiply their money.

By activating a whole new set of imaginary needs the rising real incomes in the productive sector can be absorbed and redistributed and transformed into a constantly growing demand. Without the suction effect that is caused by demand, production would soon come to a standstill. At the same time, value creation in the imaginary sector develops a momentum of its own. It is neither encumbered with practical problems like labour, scarce resources and material nor is it, like the satisfaction of physical needs, limited by inevitable saturation. In the realm of imaginary needs, value creation without limits is a possibility, at least as long as the purchasing power so generated encounters enough goods and services so that inflation cannot strip it of ist value. This is made possible by the rapidly accelerated growth of industrial production and productivity in the developed industrial societies where purchasing power and production are pushing each other along.

The key to this dynamic is human needs and wants. Anything that exceeds the basic human needs becomes an inexhaustible resource the system can explore, use, exploit and turn into monetary value. Whenever some need or want or any little part of it is gratified, value is created through the payment made for this gratification. Now any value that is created by gratifying imaginary needs has the astonishing power of buying real resources – without any limitation. The magic wand which does this conjuring trick is the money of the market economy which is unable to distinguish between the creation of real vs. imaginary value. Value creation in any currency (cf. BOX) goes into the books as a monetary value representing an abstract means of exchange that can buy anything the heart desires.

|

|

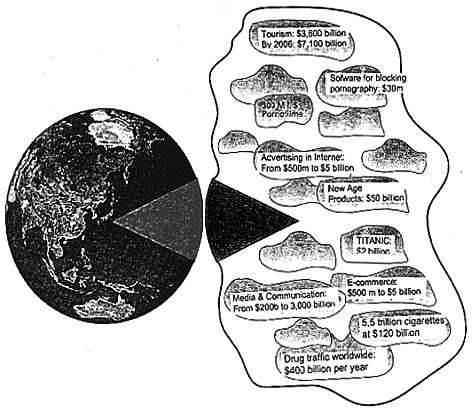

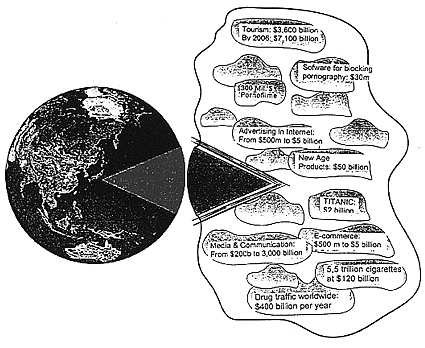

Fig. 9

|

Creating Imaginary Value

- World-wide turnover in the tourism sector in 1996: $3600 billion; Estimate for 2006: $7100 billion

- US turnover of products in the New Age sector: $50 billion

- In the space of three years (1997-2000) the number of people using the Internet is expected to grow from 20 to 200 Million, leading to an increase in Internet advertising profits from $500 million to $5 billion

- The turnover of e-commerce (Selling via the Internet) is expected to grow to 3 trillion dollars by 2003

- A painting by van Gogh ["Undergrowth"] netted 20 million dollars at an auction

- Turnover in the media and communication sector is expected to rise from today’s $200 billion to $3 trillion by the year 2010 ("A license to print money": media tycoon Roy Thompson about TV-licenses)

- Sales of 5.5 trillion cigarettes net $120 billion world-wide for cigarette producers; incidentally, is also a license to kill: In 1995, three million people died world-wide of smoking-related illnesses. In 2025, ten million people are expected to die, seven million of them in developing countries (a market that is being opened up as you are reading these words).

- Drugs: Global profits of the drugs Mafia net $400 billion each year

- Advertising through TV commercials in German television alone DM7.8 billion per year

- Coca-Cola sell 24 billion boxes of the stuff each year. Now they are exploring Africa, where people drink only 27 "eight ounce servings" each per year. Compare this to 358 cans in North America and 187 in Latin America and appreciate the dizzying potential contained in a population of 610 million, expected to grow to a billion by the year 2020. Coca-Cola doesn’t want to know about hungry mouths that need feeding - it is the thirsty throats that interest them.

This brings us straight to the core of madness inherent in the capitalist system.

Our essential, organic, absolute or physiological needs are limited. They are subject to the principle of marginal utility: when you are hungry, one loaf of bread represents great utility, the second loaf less, and by the tenth loaf, utility moves towards zero. The same applies to jumpers or woollen blankets when you are cold, and to a roof over your head for protection from rain and snow.

This limitation does not apply to the imaginary (non-essential, psychological, relative) needs. People will always crave status symbols such as big cars, beautiful houses, classy dogs and horses or famous works of art, because an individual’s underlying psychological ("imaginary") needs like a craving for security, recognition, love or identification can be fulfilled – or rather unfulfilled – in a million ways. Another way of distinguishing between these two basic groups of needs is therefore to look at them as "satisfiable/non-satisfiable" (Zinn 1995).

What this means is that the stuff from which the greater part of value creation in modern industrial societies is made can be reproduced at will. Provided the growth of the volume of money is carefully managed, the purchasing power resulting from this act of value creation has the potential to grow beyond all limitations, all the time claiming its share of Nature’s limited resources.

|

|

Figure 10: The Capitalist Market Economy’s Money Laundering Machine

|

And here we have it - the fatal flaw in the design of the modern market economy. Things are bound to go badly wrong when money - whether it derives from fulfilling real, physically limited needs or imaginary, endlessly expandable wants - is allowed to claim real and imaginary goods. By mixing up the real and the imaginary sphere, our monetary system has turned itself into a money laundering machine on a gigantic scale.

The only conclusion that can be inferred from all this is that a solid line needs to be drawn between the world of real, essential goods and that of imaginary, superfluous ones. Money is not able to distinguish between the real and the imaginary. It is sheer madness to give it equal access to both.

An economic system that allows this is bound to make such inroads on the real resources and on the life support systems of the biosphere - both naturally limited on a limited planet - that they will inevitably run out.

To stop this growth threatening the basis of life, first we must be rid of this self-accelerating motor firmly locked to its own fuel pump. One way of achieving this is to set an upper limit to the means of exchange for the acquisition of real resources by creating a strictly limited budget (which will in the first place be directed towards the supply of basics). The money of the capitalist market economy with its capacity of value creation and self-replication would then be confined to the sphere of endlessly reproducible luxury needs. There is no convertibility between the two sectors.

|

|

Figure 11

|

So, on the one hand the amount of syntropy consumed by human needs would remain limited to a sustainable level, and on the other hand, there would be a strong incentive to make a more intelligent and efficient use of a given budget without increasing demands made on the real resources - something that is inevitable in a capitalist monetary system.

3.0 One possibility of creating such a 'resource' budget would be assign to every citizen a limited budget of CO2 credits. By tying our consumption of natural resources and ecological services to a limited budget of CO2 emissions an operational and verifiable concept of sustainability is built into the economy. Our use of resources and life support systems is then determined not by what we can set in motion by human labour, cleverness and capital, but by what is maximally available in the sense of a budget (sustainable "income" from natural assets).

Human economic activities depend very strongly on the deployment of energy for transforming existing matter into useful products. We could, therefore, in a rough approximation, take human energy use as a basis for outlining a "legitimate" ecological space. H.P. Dürr's 1.5 kW strategy of is likewise based on this idea. For reasons of clarity and material immediacy, I prefer to use carbon dioxide emissions. As it is generated in all combustion processes, the greenhouse gas CO2 is highly representative for energy consumption and, therefore, of industrial output. Logically, it therefore also roughly reflects the material flows, and the foreign substances and pollutants released during these processes, all of which put pressure on the natural systems. These kinds of pollution can be significantly reduced by a policy of limiting CO2 emissions 11.

The principal argument for using CO2 emissions as a standard for a sustainable economy is the fact that there is a high degree of consensus among scientists about the permissible global levels of CO2 emissions that will not harm the planet’s life support systems. These levels can be determined with some precision, and the IPCC (Intergovernmental Panel for Climate Control, a UN body), as well as the Enquiry Commission of the German Bundestag, have calculated that if global warming is to be prevented they must not exceed about 11 billion tons per year.

The CO2 threat

There is now almost unanimous consensus among the scientific community that anthropogenic CO2 emissions have reached a level where they are beginning to change the earth's climate. If power consumption world-wide goes up to twice its current level by 2050 CO2 concentration in the atmosphere would rise to twice its pre-industrial level spelling an increase in temperatures between 2.5 and 4°C. However, such calculations are largely based on a linear approach where a 20 per cent increase has twice the effect of a 10 per cent increase.

What looms beyond these linear projections, however, are the potential run-away effects which appear to built into the climate system. Here are three examples taken from the list of the most obvious feedback mechanisms (cf. Mayer 1999: 315) which may come into play at any time (on the assumption that they have not already started):

- Methane trapped in permafrost soils: As a consequence of global warming, methane trapped in permafrost soils of the northern latitudes will be released. Methane is about 20 times as powerful as a greenhouse gas than carbon dioxide. It will therefore push up temperatures so that more permfrost soils will unfreeze and release more methane...

- Glaciers in the Alps have been retreating for many years, and ice slabs of hundreds of square miles are breaking off the Arctic ice shelf. This reduces the albedo, i.e. the reflective capacity of the Earth's surface and thus accelarates the heating process.

- The greenhouse effect enhances the depletion of the ozone layer; the increase in UV light coming through to the surface of the seas has a devastating effect on phytoplancton which is one of the largest carbon sinks of the planet.

If we accept that long term sustainable development is possible only on a basis of fair distribution of wealth then, with a global population of six billion, our quota would allow two tons of CO2 per person per year.

The current per capita "consumption" (or rather, emissions ) of carbon dioxide in industrial countries stands at 11 to 13 tons. In the USA this rises to 23 tons, while in most of the Southern countries it is much below two tons per year.

If we seriously want to make the sustainable use of natural resources and life support systems effective for the day-to-day and minute-minute-to-minute behaviour of humans the obvious way of doing so is to use this quota in the way of an annual income, as a basis of consumer spending, making it effectively into a second means of payment that is tied to a real resource. Just as the consumer nowadays is automatically paying VAT with any purchase, he would in the future be charged for the CO2 content, i. e. all carbon dioxide emissions caused in the manufacturing of goods or during the rendering of services, at the point of sale.

Carbon dioxide pollution that results from goods and services will be assigned to the product in the way of a value added tax and handed down to the consumer along the stages of production and along the chain of value creation. Let’s use the fridge as an example. The manufacturer undertakes to pay for the carbon dioxide pollution he is charged by the sheet steel supplier, who is thus passing on the charges for CO2 pollution arising from the rolling mill, the steelworks, the mining and the transport of the iron-ore that he in his turn has been charged for. Other items on this bill would be the CO2 costs of the insulating material, of the compressor, of glass and plastic parts. By the time the fridge appears on sale in the retailer’s shop, its CO2 cost will also contain a surcharge for transport from the factory to the point of sale, as well as for the retailer’s overhead costs such as heating and lighting.

Now that the consumers pay the aggregated pollution cost out of their CO2 budget, the entitlements are passed all the way back up the value chain to those places that have used CO2 rights for manufacturing in the first place.

It goes without saying that, similar to the accounting of Value Added Tax, most of these transactions take place in the accounts of the companies involved, and that the process, like the VAT system, is closely monitored by a public authority.

All the technical conditions for the practical implementation of a CO2 budget are in place. Naturally, the individual budget would not be reduced overnight to 2 tons, from its present 12 tons per year. It would happen gradually, over thirty or forty years. Each individual budget is stored on the magnetic strip of a charge card or on the chip of a smart card. Laser scanners in the supermarket or at the petrol stations then read one bar code for the price and one for CO2 content from the price label, and the card terminal charges the card accordingly.

It is a matter of course that nuclear energy has to be taken into account with an equivalent charge expressed in CO2, in the same way as energy or eco-taxes are planning to do. Let us not forget that the CO2 budget is above all about limiting material flows and transformation brought about by deployment of energy.

The obvious objection that a CO2 quota would throw us back to the post-war period with its ration cards misses the point. A CO2 quota is not an allocation of individual articles, but it constitutes a completely freely disposable budget, albeit limited. Vouchers and ration cards as we know them from the war and post-war periods represent a quantity of a particular article. They may represent half a pound of butter, or a pair of shoes, or two gallons of petrol. This puts them into the vicinity of a centralist command economy with all its clumsy bureaucratic workings, its built-in unfairness and absurd consequence of never giving people what they really need, and which can function only in tandem with a black market that will balance out the deficiencies in the system of allocation, by matching supply and production to demand.

|

|

Fig. 12 Transition from CO2 budget 2000 to CO2 budget 2040

|

There is only one thing a budget based on CO2 and resources has in common with ration coupons: both limit the amount of resources available. In every other way it can be used in the same way as money, and like money it will have an impact on supply and demand in the market and influence the allocation of resources. It will quite naturally push them in the direction of conserving energy and raw materials in favour of recycling, re-use, zero-emission cycles and renewable energies – because these are the areas where people will concentrate their spending because they are soft on their CO2 budgets. This will reward those companies who are offering goods and services which embody these principles of a new, ecological economy. A resource-based budget will ensure that after one or two decades after its introduction there will be an abundant supply of goods and services which are produced with a minimum of resources and which consume a minimum in their use.

A CO2 budget cannot be introduced over night. It will shrink from twelve to two tons per head over a time span of 40 years, i.e by a quarter ton or 2.5 per cent per year. Consequently, as from the word Go, it will be clear that in the year 2020, it will have shrunk to seven tons. This clear and undisputable perspective will create the basis for long-term structural changes, without which it is very difficult and often impossible for an individual to change one's personal life-style, energy consumption, car use, eating habits, leasure time pursuits and holiday patterns.

The transition to a CO2 economy is an emergency brake to stop the rapid course into self-destruction. It creates the material conditions which support and promote sustainable use of the life support systems – rather than penalizing it as an unbounded capitalist market economy does.

A CO2 budget which would gradually shrink in the industrial countries from twelve to two tons per head would also set us on the road to greater distributive equity worldwide. The concept of a CO2 economy determines the upper limits of individual consumption out of a fund of essential resources defined as a commons. By the same token, it makes available the "environmental space" which the countries of the South need to achieve the level of economic development which is necessary to satisfy their basic needs. In this perspective, the resource bounded economy appears as the global land reform. The point is to limit the claims of one half of humanity in order to preserve a living space for the other half. It calls an end to human beings appropriating resources they don’t need and by doing so, excluding others and depriving them of their livelihood.

Literature:

Binswanger 1994: H. C. Binswanger und Paschen von Flotow, Geld und Wachstum, Stuttgart 1994

Binswanger 1991: Hans Christoph Binswanger, Geld und Natur, Stuttgart 1991

Daly 1989: Cobb, J.B., Cobb, C.W. and Daly, H.E, For the Common Good, Boston 1989

Daly 1994: Cobb, J.B., Cobb, C.W. and Daly, H.E, For the Common Good, Second edition, Boston 1994

Daly 1999: Herman Daly, Wirtschaft jenseits von Wachstum, 1999

Georgescu-Roegen 1971: Nicolas Georgescu-Roegen, The Entropy Law and the Economic Process, 1971

Jäger 1996: Michael Jäger, Ökologischer Umbau durch Befreiung des Marktes, in: 9-10-11/1996

Jänicke-Mönch 1990: Martin Jänicke und Harald Mönch, Ökologische Dimensionen wirtschaftlichen Strukturwandels, FFU rep 90-10, 1990

Mayer 1999: Lothar Mayer, Ausstieg aus dem Crash, 1999

Meadows 1992: Donella Meadows, Dennis Meadows, Jorgen Randers, Die neuen Grenzen des Wachstums, 1992

Sieferle 1997: Rolf Peter Sieferle, Rückblick auf die Natur, 1997

Weisäcker/Lovins 1995: E. U. von Weizsäcker/Amory B. Lovins/L. Hunter Lovins, Faktor Vier, 1995

Worldwatch Institute 1999: Worldwatch Institute, State of the World 1999, 1999

Zinn 1995: Karl Georg Zinn, Wie umweltverträglich sind unsere Bedürfnisse, in: Sigmund Martin Daecke (Hg), Ökonomie contra Ökologie? Wirtschaftsethische Beiträge zu Umweltfragen, 1995

Contact F. David Peat

|